Social Bank by Robert Wood from uk

designer's own words:

FUTURE BANKING

Digital technology is transforming every aspect of our lives at an ever-increasing rate. The banking sector is currently notable for how little it has yet done to embrace digital. Getting digital banking right is a do-or-die challenge.

Automation of processes and services, mobile apps, data integration and self-servicing client’s front-end needs will happen in all major world banks as they follow the lead of early adopters, such as the world’s leading airlines, in pursuit of improved customer service that delivers a leaner operating model. We can take this as a given.

So with all leading world banks moving in the same digital direction at the same time, what will differentiate one from the other? A newer, faster app? Or something more personal?

Future Banking requires more than rethinking the impact of digital technology. It requires rethinking customer service from the roots up. Digitization will change the traditional retail banking business model. We know it will streamline operations but what it can do is liberate banks to explore radically new models of service.

Future banks become social catalysts, branches become social and business hubs enabling clients to improve all aspects of their lives with expert support, advice and service.

Cultural Brand

Social Network

Bank as Catalyst

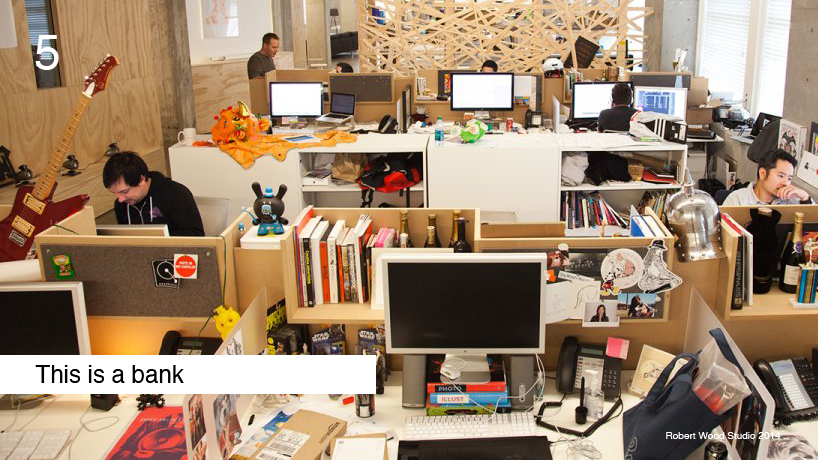

Cultural Capital

This is a bank 1

This is a bank 2