Bank Sweet Bank by giuseppe gallo from italy

designer's own words:

Bank and on line Customer Interaction

The banks aim to bring majority of their processes on line, to succeed, we think is necessary to work on trust that users have in digital instruments.

Every bank offers online services for account management, with possibility to make payments, check investments performance and operate at home, however, the response from user is relatively poor, there's a lack of incentives to interaction, no chance for users to share their experience, no perception of human contact necessary to generate trust in people.

Bankommunity

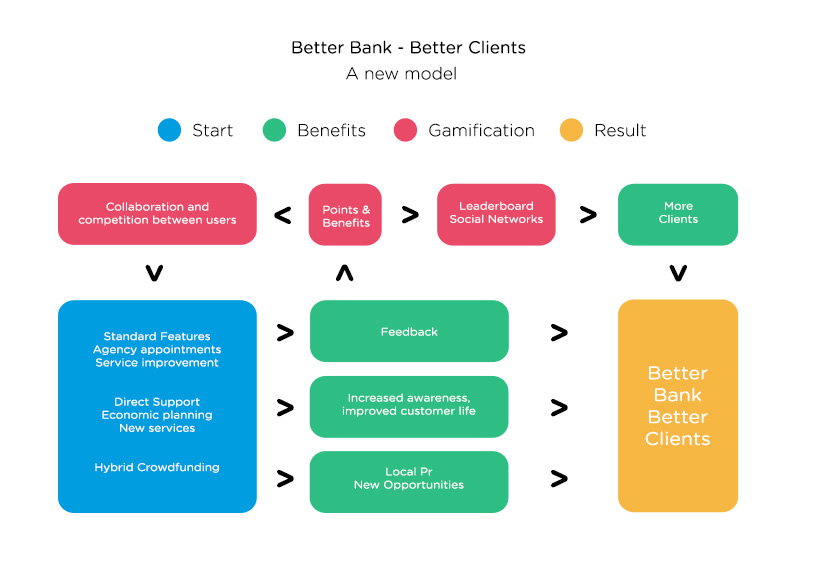

Our digital project consists in website and applications that offer, in addition to common services, a real chance of listening to customers, measuring their experience, gathering useful information to improve Bank services, internal and external public relations. Users can provide feedback about any interaction made with the bank (on-line off-line) and comment their experience. To encourage interaction we rely on gamification, introducing game mechanics as bonuses (real or virtual) and points. This way, the bank guarantees a privileged relationship with customers, which live a positive experience and are encouraged by achieved results. Our project is based on open source communities, where every user is able to help improving final products. So we give possibility to users, not only to give some feedback, but to propose new services, rate them and follow them in an eventual implementation, the same way an active community is able to support and help users directly, this eases employees work , becoming a real time and money save for the bank.

Additional Features

This mixed system of competition-cooperation has a great role to bring users to an increased use of digital tools, which can always be implemented with new features

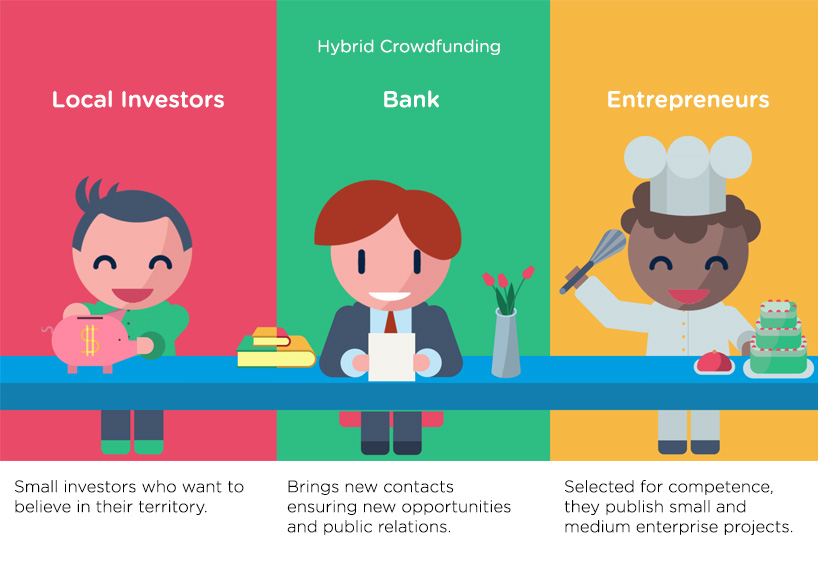

Local Netoworking for investors and entrepreneurs

Our first extra feature allows the bank to creates new possibilities for local-community, through a system similar to crowdfunding that connects local entrepreneurs and potential local investors, in this case the bankregulates contact between the two sides, carrying out advice and ensuring new economic opportunities without a real risk. An immediate benefit is perception of economic benefits that the bank creates on territory, generating positive public relations with a minimal cost

Agency appointments

A better interaction with the bank also means improving agency experience, so we imagined a system of booking and managing appointments using an easy application, allowing customers to manage their time.

Economic planning and savings

Banks play, more and more, role of real life consultant, this is the reason why we would include an advanced management of user savings, with possibility of creating objectives, determine how and when to save money, through electronic devices.

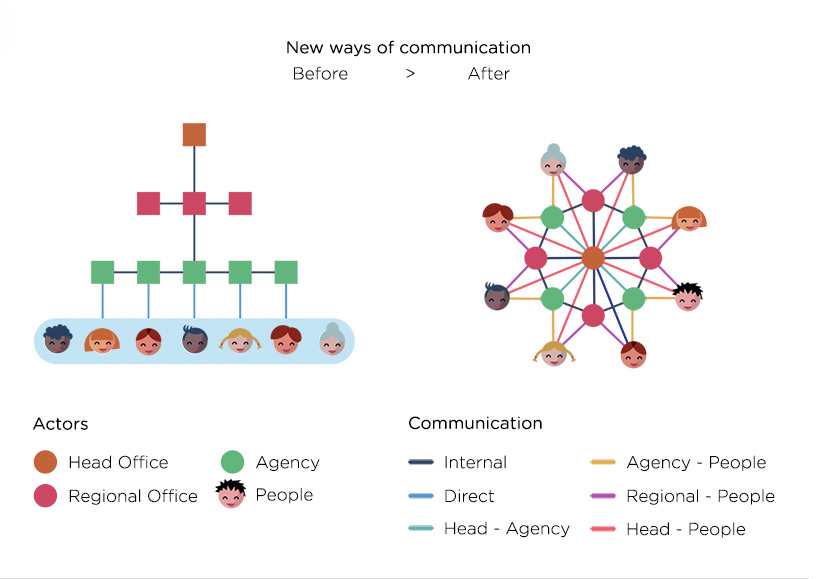

New ways of communication

Gamification

Hybrid Crowdfunding

Better Bank Better Clients